In a stunning twist, the caretaker authorities of Pakistan have just thrown a curveball at automobile consumers. Buckle up, because the General Sales Tax (GST) on automobiles priced above Rs. 40 lakh has been jacked up from 18% to a whopping 25%. But that’s not all. This car tax hike applies to all automobiles, regardless of their engine potential. Yes, you examine that properly; even your modest 1000cc experience is now rubbing shoulders with the posh crowd. Let’s dive into the details of this financial rollercoaster.

The Tax shift

What Changed

Until recently, the 25% GST was reserved for cars with engines larger than 1400 cc. But the government decided to level the playing field (or should we say parking lot?) by extending this tax to all vehicles above Rs. 40 lakh. So, whether you’re driving a sleek sedan or a compact hatchback, you’re now part of the elite tax club.

Why the Sudden Move

The International Monetary Fund (IMF) had a stern chat with our financial choice-makers. The result? A swift selection at some point of an Economic Coordination Committee (ECC) meeting. The Ministry of Finance nodded in agreement, and voilà—the tax hike was born. However, the specifics of how this coverage may be applied are still shrouded in mystery. We’re looking forward to the legitimate notification dropping, like a surprise tax bill.

The Federal Minister for Finance, Revenue, and Economic Affairs, Dr. Shamshad Akhtar presided over a meeting of the Economic Coordination Committee (ECC) of the Cabinet at Islamabad dated February 14th, 2024. pic.twitter.com/AjBUV9EOB4

— Ministry of Finance, Government of Pakistan (@Financegovpk) February 14, 2024

Winners and Losers

A handful of vehicles were controlled to escape the tax typhoon. These financially friendly options from Pak Suzuki Motor Company (PSMC) and Prince Pearl remain unaffected. If you’re eyeing any of these, keep in mind that you’re lucky:

The untouchable few

- Prince Pearl: Priced at Rs. 1,850,000.

- Alto VX: Yours for Rs. 2,251,000.

- Alto VXR: A steal at Rs. 2,612,000.

- Alto VXR-AGS: Priced at Rs. 2,799,000.

- Alto VXL-AGS: Yours for Rs. 2,935,000.

- WagonR VXR: Priced at Rs. 3,214,000.

- WagonR VXL: A budget-friendly option at Rs. 3,412,000.

- WagonR VXL-AGS: Yours for Rs. 3,741,000.

- Cultus VXR: Priced at Rs. 3,718,000.

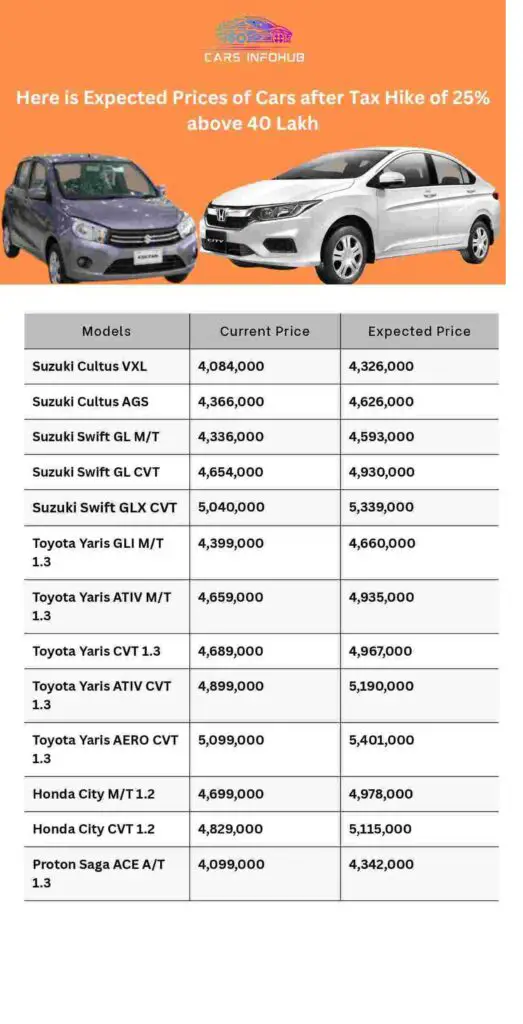

The Taxed Lot

Now, let’s talk about the cars that felt the tax pinch. Brace yourself, because these beauties are now affecting:

- Suzuki Cultus VXL: Now at Rs. 4,084,000.

- Suzuki Cultus AGS: Now at Rs. 4,366,000.

- Suzuki Swift GL Manual: Priced at Rs. 4,336,000.

- Suzuki Swift GL CVT: A luxury tax of Rs. 4,654,000.

- Suzuki Swift GLX CVT: Yours for Rs. 5,040,000.

- Toyota Yaris GLI MT 1.3: Now at Rs. 4,399,000.

- Toyota Yaris ATIV MT 1.3: Yours for Rs. 4,659,000.

- Toyota Yaris GLI CVT 1.3: Priced at Rs. 4,689,000.

- Toyota Yaris ATIV CVT 1.3: A hefty tax of Rs. 4,899,000.

- Toyota Yaris AERO CVT 1.3: Yours for Rs. 5,099,000.

- Honda City 1.2L M/T: Now at Rs. 4,699,000.

- Honda City 1.2L CVT: Now at Rs. 4,829,000.

- Proton Saga 1.3L ACE A/T: Now at Rs. 4,099,000.

Conclusion About CAR Tax Hike

As car enthusiasts, we are left pondering the impact of this car tax hike. Will it diminish our love for four wheels, or can we adjust our budgets and keep cruising? Only time will inform. But one factor’s positive: the road to car ownership just became a bit bumpier. Buckle up, fellow drivers—our wallets are in for a wild ride!

FAQs About Car Tax Hike

Why did the government boom the income tax on cars?

The decision to increase the sales tax was inspired by the aid of the International Monetary Fund (IMF). As a part of monetary reforms, the authorities raised the tax rate to fulfill financial goals.

Which vehicles are laid low by the tax hike?

All motors priced above Rs. 40 lakh are impacted, regardless of their engine potential. Previously, the simplest automobiles with engines larger than 1400 cc faced a better tax.

Are there any exceptions?

Yes, some finances-friendly alternatives from Pak Suzuki Motor Company (PSMC) and Prince Pearl stay unaffected by using the tax hike. These include the Prince Pearl and diverse Suzuki Alto and WagonR editions.

What about luxury vehicles?

Luxury automobiles like the Suzuki Swift, Toyota Yaris, and Honda City now bring a heavier tax burden. For instance, the Suzuki Swift GLX CVT is priced at Rs. 5,040,000 after the tax growth.

How will this impact vehicle buyers?

Car lovers may need to modify their budgets or discover more cheap options. The road to automobile ownership just got bumpier!

1 thought on “From 18% to 25%: Decoding Pakistan’s Car Tax Hike”